A rebuttal to the anti-soda-tax arguments

Jul 13, 2010, Updated Sep 20, 2018

Back in May I wrote about the push for a Soda Tax. A few days ago, over at change.org’s Sustainable Food section, they wondered if a soda tax will really help curb obesity.

I keep seeing the same arguments against a soda tax again and again, so I’d like to offer my rebuttals.

“A soda tax won’t reduce consumption.”

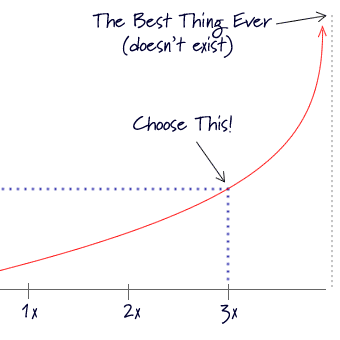

Sure it will. It may not be a deterrent for everyone, of course, but it will be for some (many?), and will therefore be a step in the right direction.

As reported by the Washington Post, a USDA study indicates that a “20 percent increase in the price of high-calorie, sweetened beverages, such as soda and sports drinks, could result in a decrease in the daily calorie intake of beverages by 37 calories for an average adult and 43 calories for children. That translates into an average reduction of 3.8 pounds over a year for an adult and 4.5 pounds for a child.”

In a recent real-world test, Harvard researchers raised the price of a 20-ounce bottle of full-calorie soda by 45 cents (a 35% price increase). This caused sales to drop by 26 percent.

“It won’t solve the obesity problem in America.”

Of course it won’t solve the entire obesity epidemic; to think it would do so is just silly.

However, every little bit helps, and we need to attack this problem from multiple angles. I also think that is an opportunity to have more than “a little bit” of positive impact.

Soda is a huge factor in our obesity problem, and therefore reducing high-calorie, sugary-beverages is one of the best places to start.

“A soda tax is an unfair burden on poor families.”

That’s faulty logic. If you’re poor, you shouldn’t be spending your money on soda in the first place. And if you’re truly destitute, you aren’t buying soda anyway. [Update: I probably could have used a better word than “shouldn’t” in the previous paragraph. See discussion in the comments section below.]

Soda delivers calories that are nutritionally devoid. It’s simply not a healthy or cost-effective way to feed your family.

Soda is not nourishing food. It used to be considered a luxury item, enjoyed much less frequently and in smaller amounts, and it’s time we reverted back to that idea.

<h3″A reduction in soda intake will be offset by an increase in other junk foods.”

Liquid calories (like those in soda) are not registered by the body in the same way that solid calories are. By drinking your calories, you end up consuming more calories overall.

Reducing soda consumption, therefore, would ultimately result in a net reduction on the average calorie intake of Americans.

“I don’t want the government telling me what I can and can’t eat!”

I don’t want the government controlling my diet, either — but that’s not at all what’s going on here. The proposals are not to ban soda, just to tax it.

Taxing is not “government control,” since it does not limit what you can and can’t do, buy, or eat. (Your budget may limit that, and taxes have an effect on your budget, but it is not direct control of what you can and can’t do.)

But if you do want to stop any and all government control over food, then we also have to keep the government from subsidizing corn and giving tax breaks to the food industry. And how about food safety legislation? Don’t you want the government assuring that our food supply is safe? So where do you draw the line?

Considering the overwhelming evidence that soda (a non-essential, luxury item) causes harm to individuals AND society, someone has to pay for that burden; it should be the people consuming the soda, not society as a whole.

(See also: Who decides what you can and can’t eat?)

“Taxing soda is a ‘slippery slope.'”

This, too, is a faulty argument. It’s alarmist rhetoric that makes for good headlines.

Taxes on soda aren’t new – 33 states already charge sales tax on soft drinks (at an average rate of 5.2%).

We heavily tax cigarettes because we know they’re bad for us (and it is an effective deterrent — the CDC says a 10% increase in taxes results in a 4% decrease in smoking).

We already have different tax rates for foods and other items, and even different tax rates if food is “for here” or “to go.”

Although a soda tax might be one more bit of government intervention into the free markets, it would not have a snowball effect or push us down a “slippery slope.”

“Parents need to do their job and control/teach their children.”

I’d agree with that — there is certainly truth here. However, it’s not a level playing field. Kids are inundated with commercials and advertising, as well as many hours where they are not under their parents’ watchful eyes (school? friends’ houses?) — and when soda is offered at school, there’s not much parents can do about it.

What kid isn’t going to want a soda with his lunch, when it’s readily available? Sure, parental influence is a huge and important factor, but parents are no match for the food industry.

—

What other arguments against a soda tax have you heard? Do you disagree with any of this? Post in the comments below!

Further reading: Check out this report from Yale’s Rudd Center for Food Policy & Obesity (PDF).

Photo by Targeteer2k.

Marion Nestle posted on her blog yesterday about the current Richmond ballot penny-per-ounce initiative. Good discussion: http://www.foodpolitics.com/2012/07/soda-taxes-and-other-measures-designed-to-fight-obesity/

This just in:

The situation is actually worse than just subsidizing corn. Taxpayers actually directly subsidize the purchase of soda.

“The soft drink industry receives a $4 billion subsidy from taxpayers each year… that’s about how much carbonated soda is purchased with money from the Supplemental Nutritional Assistance Program (SNAP), the program formerly known as Food Stamps. ”

“SNAP participants appear to purchase at least 40 percent more carbonated soft drinks than other consumers do. ”

“…the USDA actually prohibits the use of SNAP-Ed grants for campaigns that steer people away from junk foods. USDA stopped health officials in the city of San Francisco, and the states of Maine, California, and Wyoming from using federal money for programs aimed at reducing soda consumption.”

http://www.cspinet.org/new/201007151.html

Here’s a great article from Larry Cohen, Executive Director of the Prevention Institute, on HuffPo a few days ago:

http://www.huffingtonpost.com/larry/as-american-as-apple-pie_b_639631.html

I will say that the only concern I have with the notion of a soda tax is the government subsidy on corn, which–as you noted–is the big reason why soda is so cheap, and thus why we end up drinking more of it than we should. The key thing there is “government subsidy”, which means from the government coffers, which means from taxes, which means from us, the taxpayers. Who are buying the soda. I just can’t bring myself on fundamental grounds to pay to make corn cheap, then pay again to make it not-cheap. It’s like paying a monthly fee to get cheaper movie tickets, then agreeing to raise the price on those tickets because they’re too cheap now. I know we have to find a practical solution, and fully repealing the subsidy isn’t an easy or quick (or even likely) thing to go after, but I’d also rather… Read more »

“If you’re poor, you shouldn’t be spending your money on soda in the first place.” Hi Andrew, I love your blog, but I find this statement to be a bit off-putting. Who are we (folks who are not poor by definition) to tell others what they “should” or “should not” be spending their money on? I agree that soda is extremely unhealthy. It’s not something I usually drink, but then again I drink a lot of coffee, which some doctors/nutrionists/etc. say is “bad” for me. Likewise, I agree that there are many poor people in this country who do not eat a healthy diet, which is due to both a lack of education, but also just a lack of funds and often limited food choices in their neighborhoods. I’d love to see organic farmers, organic food companies and supermarkets like Whole Foods discount their prices and/or do more for people… Read more »

Hi Caroline, I probably should have qualified that statement, so thanks for calling me out on that. I believe that NONE of us, rich or poor, “should” be drinking soda (though yes, in moderation it probably isn’t harmful, and I too enjoy a soda from time to time). I also certainly didn’t mean to imply that rich folks should be “allowed” to drink soda and poor folks not. But an individual’s choice to buy a bottle of a coke does indeed impact others, particularly if that person is unable to pay for his own medical costs. If he develops medical problems because of the way he eats, why should the rest of us pay for his treatment of his preventable disease? Please don’t misunderstand: I’m not saying that we should stop providing healthcare to people that can’t afford it. However, the money has to come from somewhere, and why not… Read more »

if you replaced “soda” with “cigarette”, I’d feel like I was in a time warp.

Why is taxing soda an unfair burden on poor families? if poor families in this country don’t have access to clean tap water for free, then that’s a root cause that needs to be addressed.

But it is a slippery slope. Define “soda.” The beverage market is huge. I consider Sunny D to be on the same page as coke, but they’d attempt to posit themselves alongside Orange Juice. What about Kool Aid, or Crystal Light? Or Lipton’s “Green Teas,” so packed with sugar it curls the teeth. Take a look in the 7/11 cooler and see what exactly we could tax.

Hi Ruth,

I hadn’t considered the slippery slope in that regard, but you make a good point. I’ve been using “soda” to mean any beverage with significant amounts of added sugar. (not exactly sure how “significant” would be defined). So 100% orange juice wouldn’t count, but SunnyD? You betchya, I say we should tax that like crazy.

SunnyD Ingredients: Water, High Fructose, Corn Syrup and 2% or Less of Each of the Following: Concentrated Juices (Orange, Tangerine, Apple, Lime, Grapefruit). Citric Acid, Ascorbic Acid (Vitamin C), Beta-Carotene, Thiamin Hydrochloride (Vitamin B1), Natural Flavors, Food Starch-Modified, Canola Oil, Cellulose Gum, Xanthan Gum, Sodium Hexametaphosphate, Sodium Benzoate To Protect Flavor, Yellow #5, Yellow #6

BTW – the blog is awesome!

Thanks! 🙂

(Tell your friends!)

OK, AW, I’ll play. I’m going to rejoin “I don’t want the government telling me what to eat” Andrew said, “Taxing isn’t ‘government control’, since it doesn’t control what you can and can’t do…”. But, you argued above that it will decrease consumption. While it’s true that tax something is not the same as outlawing something, it is (by your own admission) an attempt to socially engineer our behavior. So you can’t have it both ways, either the tax is trying to get us to engage in (or refrain from) certain behaviours or it isn’t. I say it is, and I say that’s inappropriate for tax policy. Andrew said, “we also have to keep the government from subsidizing corn and giving tax breaks to the food industry” Ok, sounds good to me. I agree. Andrew said, “And how about food safety legislation? Don’t you want the government assuring that our… Read more »

Hey Dan, As I was reading your well-argued counterpoints, it brought me back to the real the crux of the problem: Corn subsidies. Because our government subsidizes corn production, soda is significantly cheaper than it would be otherwise. Eliminating the corn subsidies would, in my humble opinion, solve the problem, since the price of soda would likely rise to a point that would reduce its consumption. However, that’s not likely to happen anytime soon, so we need to find alternatives. There are myriad effects of the obesity epidemic that are indeed borne by society (or perhaps, “others”), and I’d argue it’s not practical for all the costs to be paid for by those who are obese. Two quick examples: Diet- and inactivity-related diseases increase costs to businesses. Medical costs of General Motors employees increased from $2,225 to $3,753 per year with increasing body mass index (BMI) of the employee. (not… Read more »

Let me get this straight a tax on soda is an unreasonable burden on the poor.

But, extending unemployment benefits is helping people to not become too dependent on unhealthy addictions (in this case, dependence on “government handouts”).

And a public health care plan (as one option among private plans) is dangerous.

What a looking-glass!

BTW, where I live, a 20-oz bottle of soda costs $1.69 at most KwikE Mart-type places (plus a bottle deposit, plus sales tax – because soda is not a food, but a good). A half-gallon of milk (32 oz) in the same marts costs $1.99 (no bottle deposit or tax). It seems that “the poor” are already being burdened, just by what the market will bear.

I crave diet soda. I welcome a tax that makes it more burdensome for me to buy it.

Well said, Julie. As someone who (thankfully) isn’t “burdened” by soda prices, I’d also prefer it to be more expensive. Coke Zero is a particular weakness of mine (yeah, I’ll admit it)… Although it wouldn’t fall under the purview of a soda tax (as they’ve been proposed, at least, since it is a “diet” beverage), I think it should be more expensive so I’ll be less inclined to buy it. (and when I do, it’ll be more of a “treat,” and I’ll appreciate it that much more).

I’ll also be writing about this soon in the context of the Sodastream I bought a little while back — How increased availability leads to increased consumption… even for those of us who are highly-focused and motivated in this area.

Couple points: A soda tax IS an unfair burden on poor families. All point-of-sale taxes are. But let them eat cake.

I doubt 20% is high enough. It took 200-500% increases in taxes to have any impact on cigarette sales. Carbonated sugar water is pretty addictive too. CSW is still cheaper than non-CSW like Gatorade and fruit juice and are those any better?

I suppose a soda tax is an “unfair burden” on poor families the same way the luxury tax on a yacht is an “unfair burden’ on wealthy families. Drinking soda should be a luxury, not a right. The new study at the USDA estimates that a 20% price-increase could reduce obesity levels in the US from 33.4% to 30.4%, which is about a 10% reduction. That this one tactic could have such a significant impact seems pretty good to me, but I certainly agree that simply increasing prices alone won’t solve our problems. This study estimated that a tax-induced 20-percent price increase on caloric sweetened beverages could cause an average reduction of 37 calories per day, or 3.8 pounds of body weight over a year, for adults and an average of 43 calories per day, or 4.5 pounds over a year, for children. Given these reductions in calorie consumption, results… Read more »